In the dynamic realm of artificial intelligence (AI), where innovation propels the tech sector to new heights, two under-the-radar stocks are gearing up for a remarkable journey. The AI landscape of 2023 is witnessing a bull run, and these two stocks, The Trade Desk (TTD 1.88%) and Atlassian (TEAM 3.80%), are poised to redefine the game. Beneath the surface, these stocks are charting their course, fueled by AI prowess, yet remaining undervalued in the eyes of investors. Embark on a journey to understand how these companies are positioned to leverage AI and carve their niche in this transformative landscape.

Unveiling the Potential of The Trade Desk and Atlassian in the AI Revolution

The AI landscape is a vibrant arena, with tech stocks soaring to unprecedented heights driven by the power of artificial intelligence. However, not every player is riding the same wave of success. In this landscape, two companies, The Trade Desk and Atlassian, are poised to rise above the rest. These dark horses are set to embrace AI and its transformative potential, positioning themselves for success in the long haul.

Navigating The Trade Desk’s AI Transformation in the Digital Advertising Space

As a prominent player in the digital advertising arena, The Trade Desk has weathered the storm of an industry-wide downturn. This scenario mirrors the reality of an inflation-driven economic crisis, where tightened purse strings lead to a slowdown in marketing campaigns. When consumers are cautious about spending, ad buyers naturally curtail their investments in advertising.

However, The Trade Desk is already undergoing a remarkable turnaround, with its stock surging by 66% in 2023. The pressure from the government’s anti-inflation measures has eased, and the company is benefitting from the ongoing AI frenzy. Notably, The Trade Desk did not hit the brakes on real-world revenue growth, consistently achieving impressive year-over-year growth rates, including a solid 21.4% growth during the inflation panic.

Amid this promising resurgence, the digital advertising landscape is poised for a resurgence. As the economy recovers from the inflationary impact, there is anticipation of a strong comeback in ad sales. A backlog of marketing needs, coupled with businesses’ continuous development of innovative products and services, is set to propel ad campaigns to the forefront. The Trade Desk is poised to facilitate these delayed marketing efforts, connecting them with the right display channels at optimal pricing.

What sets The Trade Desk apart is its pioneering use of AI. The company’s Koa AI platform, predating the AI trend, enables clients to analyze target audiences and execute targeted ad campaigns. This platform harnesses the power of data analysis, processing over 600 billion end-user interactions daily. The future growth trajectory of The Trade Desk is firmly anchored in the unparalleled sophistication of AI-driven data analytics.

Intriguingly, despite its impressive market standing and substantial year-to-date price surge, The Trade Desk’s stock remains undervalued, trading at a 35% discount from its peak prices in 2021. This latent potential positions it for an upcoming bull run, promising significant growth over the next few years.

Atlassian’s AI-Powered Transition to Cloud Services

Australian-based Atlassian, the driving force behind collaboration and project management tools like Jira, Trello, and Confluence, is embracing AI in its cloud-based tools. This integration serves multiple purposes, including enhancing user experiences, simplifying access to vast data repositories, and enabling robust data analytics to yield actionable insights.

However, Atlassian’s AI integration journey takes an intriguing turn as it collaborates with OpenAI’s GPT engine. The company’s strategic shift toward cloud-based services is further fueled by the surge in AI capabilities. By marrying its cloud-based tools with OpenAI’s generative AI system, Atlassian is encouraging clients to transition from traditional software licenses to cloud subscriptions.

OpenAI’s cloud-based generative AI aligns seamlessly with Atlassian’s cloud-focused approach. The rationale behind this alignment is simple: if clients seek to harness integrated analytics and chatbots powered by OpenAI’s tools, they must fully embrace the cloud platform. This strategic move effectively pushes the last vestiges of non-cloud clients toward the cloud, catalyzed by the allure of AI-enhanced features.

By leveraging inherently cloud-based AI capabilities, Atlassian crafts a persuasive incentive for non-cloud customers to transition to software-as-a-service subscriptions. This approach bolsters the company’s subscriber count and contributes to a more profitable revenue stream.

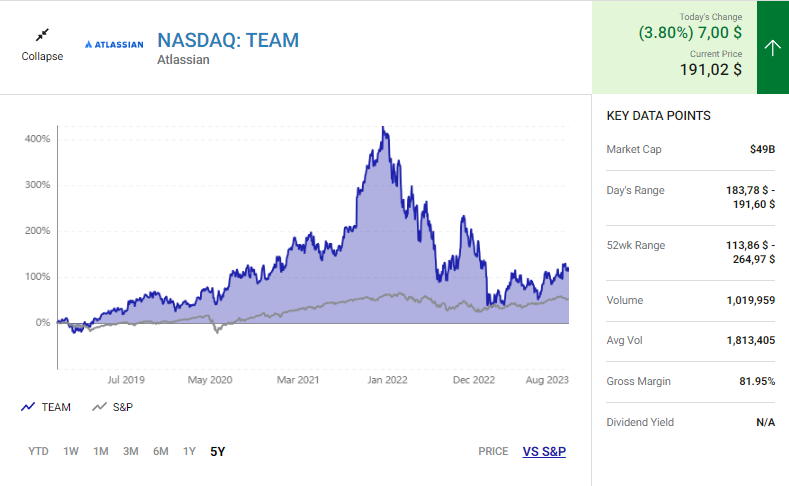

Exploring Atlassian’s Growth Trajectory and Stock Potential

The remarkable potential of Atlassian extends beyond its AI integration. While the stock has achieved a 43% year-to-date increase, it still sits at 61% below its peak price from 2021. Although not necessarily inexpensive in terms of valuation metrics, Atlassian’s robust growth and ability to generate substantial cash flow position it as a high-performing AI investment.

In conclusion, the landscape of AI stocks is evolving, presenting hidden gems that are poised for significant growth. The Trade Desk and Atlassian, with their innovative AI-driven strategies, exemplify the potential to shine in the AI revolution. As these stocks redefine the contours of AI-powered success, investors have a unique opportunity to partake in their growth journey.