Could the copper-gold ratio, a substantial wager by a renowned hedge fund manager, and adverse movements in yield curves be indicative of challenging economic times on the horizon?

“Sell during May, return around St. Ledger’s Day” represents the traditional pattern followed by stockbrokers in London. They typically close their positions for the summer, take a break in Mediterranean destinations, and only concern themselves with the market upon their return.

Although this practice is not as strictly adhered to as it once was, for those who did sell their holdings in May, the time is approaching to reenter the market—St. Ledger’s Day falls on Saturday, September 16.

But what awaits them upon their return? As it turns out, those who were absent have missed out on a considerable amount of market activity, much of which could potentially bring difficulties upon their reentry.

The story includes the fact that central banks were not done with raising interest rates in May. Rates experienced at least two increases in the United States, the eurozone, and the United Kingdom. While inflation began to show signs of decline, it remained persistently high in the UK.

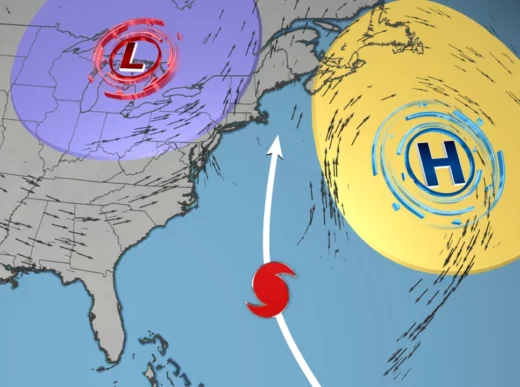

Concerns heightened as the US Treasury’s yield curve inverted further in June. An inverted yield curve arises when short-term bonds yield higher interest rates than long-term bonds.

In 2006, yield curves exhibited inversion for a substantial portion of the year. This led to long-term Treasuries surpassing stock performance in 2007. The subsequent year marked the occurrence of the 2008 stock market crash and the commencement of what later came to be known as the Great Recession.

While not an everyday headline, the occurrence of a deep inversion in early July, the most significant since 1981, garnered significant attention. This is due to the fact that inverted yield curves can serve as indicators of potential recessions, and this specific inversion has been signaling a recession for over a year, as stated by Russ Mould, the Investment Director at AJ Bell, in an interview with The National.

Prominent figures in the investment realm shared pessimistic viewpoints regarding the stock markets during the summer months. Citigroup projected that the S&P 500 could decline by approximately 10 percent by year-end. Notable bearish voices from Wall Street, such as Mike Wilson from Morgan Stanley and Marko Kolanvovic from JP Morgan Chase, reiterated their negative forecasts in July.

In the current year, stock markets have performed well, particularly in the United States. The Dow Jones Industrial Average has risen by 4 percent, while the Nasdaq has experienced a nearly 30 percent increase.

British billionaire investor Jeremy Grantham, a co-founder of the investment management company GMO, holds the belief that speculative bubbles are forming, increasing the likelihood of a market crash to around 70 percent.

Michael Burry, known for earning $100 million from short positions leading up to the 2008 subprime financial crisis, recently placed a comparable bet of $1.6 billion against the S&P 500 and Nasdaq in the United States.

It is believed that Mr. Burry, who was portrayed by Christian Bale in the movie “The Big Short,” is allocating over 90 percent of his hedge fund’s portfolio to his projection of a market crash before the year concludes.

While the intrigue and speculation surrounding this situation generate compelling headlines, analysts employ various mathematical methodologies to compute potential market shifts and economic trajectories.

Among these tools is the copper-gold ratio.

Given that the copper-gold ratio incorporates the values of two metals serving distinct purposes, economists and market strategists utilize it to gauge potential upcoming economic downturns.

Copper functions as an industrial metal and offers insights into global economic vitality. Its extensive application in construction, infrastructure, and technology implies that robust demand for copper indicates expanding economies. In fact, due to its capacity to reflect economic health, copper is frequently referred to as “Dr. Copper.”

Conversely, gold has historically served as a haven of value during periods of turmoil. It stands as a secure investment option with minimal industrial utility. When the worth of other assets faces erosion due to escalating inflation or debt, the allure of gold for investors tends to increase.

Consequently, the interplay between copper and gold prices emerges as a crucial instrument for traders and a mechanism employed by economists in their endeavors to forecast upcoming economic trajectories.

“A study examining the copper-to-gold ratio could provide valuable insights,” remarked Russ Mould, the Investment Director at AJ Bell.

He continued, “If copper demonstrates stronger performance, it might signal that favorable conditions could persist. On the other hand, if the precious metal outperforms its industrial counterpart, it could serve as an indicator of potential adversities, such as an outbreak of inflation or a recession, and in the worst scenario, a simultaneous occurrence of both, reminiscent of the stagflation experienced in the 1970s.”

Hence, as the value of gold increases and that of copper decreases, the copper-gold ratio diminishes, and vice versa.

When copper’s price rises while gold’s price falls, the ratio diverges significantly from the 30-year average, indicating a burgeoning economy. Conversely, this divergence points towards an impending recession.

Janet Mui, Head of Market Analysis at RBC Brewin Dolphin, underscored, “I believe it is beneficial for assessing economic momentum. When the ratio ascends, it generally aligns with growing economic activity, given copper’s role as a proxy for industrial commodity demand. When overlaid with other indicators, it can help identify disparities or deviations between the ratio and other market cues, such as bond yields.”

However, within the realm of analysis, various tools are at the disposal of market strategists and economists. The copper-gold ratio is just one among them. Its utility fluctuates relative to other indicators and specific developments.

“As is often the case, nothing can be flawlessly precise,” pointed out Mr. Mould. “Because if it were that straightforward, we’d all be comfortably situated at home or by the seaside, wouldn’t we? People are perpetually in search of such guiding signals, and previously reliable mechanisms like an inverted US yield curve, which has persistently signaled a recession for well over a year, are currently proving unreliable.”

He further added, “Nevertheless, we must all recognize the principle that past performance doesn’t guarantee future outcomes, even though it has commonly served as a dependable guide.”

Ms. Mui concurred that, akin to all analytical tools, the copper-gold ratio cannot be deemed an infallible predictor of recessions. She explained, “For instance, the ratio stood above 10 when the 2008 recession commenced. There have been multiple instances when the ratio fell below one standard deviation from the 30-year average, yet no recession ensued.”

China worries

Furthermore, copper prices often display considerable volatility due to a combination of structural and cyclical demand factors. China’s ambitious urbanization efforts over the past few decades have significantly bolstered copper prices. However, this foundation seemed somewhat unstable due to a deflating property bubble in the country’s real estate sector.

Recent analysis conducted by S&P indicates that over 50 Chinese property development companies have defaulted on their debts within the last three years.

Nevertheless, the shift towards achieving a net-zero energy transition is generating fresh demand for copper. The production of electric vehicles stands as a prime example of copper’s utility in a post-fossil fuel era.

The energy transition played a significant role in the optimistic profit projection by Aurubis, Europe’s largest copper producer. After reporting a 20 percent surge in quarterly earnings last week, the company revised its profit forecast upward for this year.

This situation has engendered a market discussion regarding the forthcoming direction of copper prices.

Golden future?

Presently, gold prices are grappling with uncertainty regarding their trajectory. The valuable metal demonstrated a robust performance in the initial half of the year, achieving a 5.4 percent increase.

However, if, as some experts anticipate, the world’s major central banks shift from a stance of tightening monetary policy to maintaining interest rates at their current levels, the potential for gold price escalation could become constrained.

“Despite indications of moderating inflation, the blend of stock market fluctuations and the presence of ‘event risk’—which encompasses scenarios like geopolitical tensions or financial crises—is anticipated to sustain hedging strategies, including those involving gold,” recently remarked the World Gold Council.

At the very least, the copper-gold ratio underscores the peril of relying solely on a single indicator for prognosticating future occurrences.

Starting blocks or precipice?

Nonetheless, a consensus seems to be emerging that the upcoming autumn could bring a series of notable events. Conflicting perspectives abound regarding the course events and metrics will chart for both markets and economies.

Kevin O’Leary, the Canadian entrepreneur and prominent figure on the TV show Shark Tank, has expressed reservations about Michael Burry’s sizable wager against the S&P 500 and Nasdaq, deeming it a “very risky” move.

Many economists maintain an outlook of a gentle landing for the US economy, perceiving this outcome as a distinct possibility, given the alignment of numerous indicators in that direction. Additionally, the Federal Reserve appears to be nearing the zenith of its tightening cycle.

Nonetheless, the repercussions of multiple interest rate hikes on the US economy remain uncertain, considering that the impact of such rate adjustments typically takes effect over a span of six to 18 months.

Earlier in May, a survey conducted by Bloomberg among investment firms targeted a year-end S&P 500 level of 4,000. However, this projection has since been revised upwards to 4,300.

From the perspective of Mr. Mould at AJ Bell, discernible risks exist, particularly in the realm of US equities, which appear to be overvalued. The Magnificent Seven, comprising prominent tech giants like Microsoft, Apple, Amazon, Google’s parent company Alphabet, Tesla, Nvidia, and Meta, wield considerable sway over market indices due to their substantial size and influence.

“While these factors naturally instill a sense of unease, they’ve evoked a sense of caution in me for the past year and even the year before that,” he shared with The National.

He concluded, “Ultimately, we lean on the age-old adage that anything unsustainable will inevitably reach a point of cessation, yet the timing of such an event remains elusive.”