Summary

Last week witnessed significant declines in major indices, plummeting by over 2%, particularly impacting the technology sector. As the Nasdaq’s rapid ascent momentarily pauses, it could be prudent to explore seizing opportunities during this market dip. The technology domain continues to progress, and the fervor surrounding artificial intelligence (AI) offers stocks that wield competitive edges, presenting substantial prospects for remarkable growth. Our evaluation encompasses 89 AI-related stocks, pinpointing three prominent Mega-Tech Strong Buy stocks centered on AI. Historically, these three stocks were reasonably valued according to quantitative assessments. However, a recent dip in stock prices, coupled with heightened growth projections by analysts and compelling valuation models, have revealed that these stocks are currently mispriced. For those on the lookout for premier AI-affiliated corporations boasting impressive revenue and earnings expansion, robust profitability, and buoyant analyst appraisals, it’s worth considering these three elite AI stocks, each equipped with distinct competitive advantages and strong quantitative assessments.

Mega Cap Stocks Lead the U.S. Market Rally

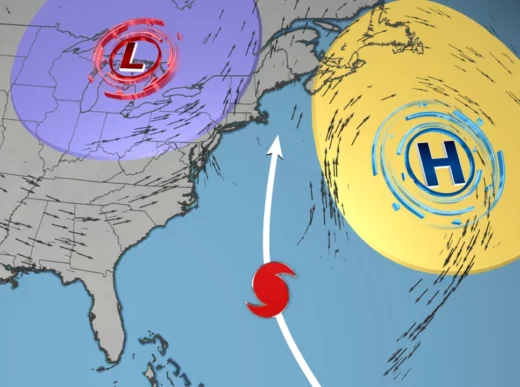

In 2023, U.S. stocks have experienced a strong surge, primarily driven by Mega-Tech stocks that have spearheaded the rally. The NASDAQ Composite index has surged by more than 30% year-to-date.

Year-to-Date Performance Comparison: S&P 500 vs. Dow Jones vs. Nasdaq

Amidst the AI excitement, the tech-centric Nasdaq stands as one of the most popular sectors, drawing investors aiming to capitalize on artificial intelligence’s immense potential for returns. This positive sentiment has propelled companies like NVIDIA (NASDAQ: NVDA), dubbed the ‘Godfather of AI,’ to a bullish trajectory. As a global leader in semiconductors and AI hardware and software, NVIDIA’s May earnings report triggered a surge in AI-related stocks and set the Nasdaq on an upward path. The Q1 earnings announcement not only propelled NVIDIA’s stock by +218% year-to-date, but it also lifted the Nasdaq and other top tech and AI stocks.

Market analysts anticipate Nvidia to surpass its 52-week high as anticipation builds for the release of its second-quarter results. Projections forecast an EPS of $2.09, a significant growth of 309% from the same period last year when it was $0.51. Additionally, the forecast for EBIT is $5.93 billion, indicating a remarkable 348% increase from the previous year.

Despite its robust growth, profitability, momentum, and impressive EPS, Nvidia’s stock has been significantly overvalued since its Q1 surge, leading to an overall valuation grade of ‘F.’ This premium valuation is underscored by a trailing P/E ratio of 153.49x, starkly contrasting with the sector median of 19.37x – a notable 692.28% deviation from the sector norm. This is compounded by several underlying ‘F’ grades that contribute to the stock’s Hold rating, overshadowing its otherwise outstanding A-rated Factor Grades.

However, from a quantitative standpoint, a crucial metric is the PEG ratio. In terms of valuation, this metric appears appealing with a Quant ‘B’ grade, as the ratio stands at 1.48x, compared to the sector median of 1.81x, representing a 20% discount relative to the sector’s value on this metric.

Therefore, it’s plausible to assert that the stock holds appeal at its current level, notwithstanding Nvidia’s Hold rating. As I seek out stocks that exhibit mispricing, I have identified three prominent giants that not only leverage Nvidia’s offerings but also stand among the foremost names in the tech industry, positioned to reap the rewards of the AI surge.

Meta, Amazon, and Google: Strong Buy Stocks

Their names are universally recognized: Meta, Amazon, and Alphabet, known as Google. Collectively, they constitute a significant portion of the S&P 500 and Nasdaq 100 indices. While their valuations often appear exceedingly inflated, my quantitative analysis has identified these AI Mega-Tech entities as compelling undervalued opportunities.

Artificial intelligence stands out as a pivotal domain within technology, attracting substantial investment due to its transformative breakthroughs, impressive growth narratives, and wide-ranging applicability. Even the most prominent players in the tech industry are keen to join this trend. Meta has introduced an encompassing AI model for language and speech translation. Amazon offers a comprehensive array of services and tools designed to harness AI for operational needs and expansion. Additionally, Google has recently introduced an AI Chatbot.

Companies are actively embracing AI technology to gain a competitive edge, aiming to leverage its benefits like enhanced efficiency, cost-effectiveness, scalability, and improved customer interactions. Remarkably, despite trading at a comparatively higher valuation, each of my selections boasts excellent ratings.

The Seeking Alpha Factor grades gauge investment attributes within a sector-relative context. As evidenced above, each of my three selections comes with a slightly elevated valuation. Nevertheless, their Growth, Profitability, Momentum, and Revisions Grades emphasize their strong foundational position, positioning them as highly profitable entities within their respective sectors and industries.

Although the valuation grades for these stocks are categorized as D or D+, any minor dip in their valuations could lead to a transition from Strong Buy to Hold. However, this reclassification doesn’t imply a recommendation to sell, as these stocks retain their robust fundamental strength. Notably, Amazon has recently been classified as a quant Strong Buy, while Alphabet and Meta have maintained their Strong Buy status. The factor grades are subject to change as they ascend in trading value and valuations moderate.

Nonetheless, considering their present price levels and positive momentum, our quantamental analysis identifies these stocks as attractive buying opportunities in case of a market dip. A more comprehensive examination of each stock follows.

Best AI Stocks to Buy

Amid the race towards digital transformation and the advancement of various industries through artificial intelligence, the titans of the tech world are vying to provide streamlined, expedited, and cost-efficient solutions, harnessing the capabilities of AI. I’ve curated my top three AI stocks by combining data from four of the largest AI ETFs and refining the selection from an initial pool of 89 stocks featured in an AI Quant portfolio. By harnessing the capabilities of our portfolio tool, as illustrated in the table below, investors can effectively compare stocks ranging from Strong Buy to Strong Sell.

The collective monthly performance of my 13 Strong Buy selections averages at -1.23%, a notable contrast to the performance of the 13 Sell/Strong Sell stocks, which stands at -27.78%. This substantial difference underscores the superior performance achieved by the Strong Buy stocks.

While both Meta and Alphabet have previously held positions on my Strong Buy list, the inclusion of Amazon to the lineup adds a favorable dimension as we near the fourth quarter and the festive holiday spending period.

1. Meta Platforms (NASDAQ:META)

Market Capitalization: $728.85 billion

Quant Rating: Strong Buy

Quant Sector Ranking (as of 8/22/23): Ranked 1 out of 249

Quant Industry Ranking (as of 8/22/23): Ranked 1 out of 61

Previously known as Facebook, Meta Platforms Inc. is a company deeply involved in social media, virtual reality, and AI-driven innovation, focusing on creating products that facilitate global connections and content sharing. Backed by robust fundamentals, strong growth prospects, and remarkable profitability, Meta has effectively harnessed AI to revamp its offerings, including notable releases like Threads and Reels. The latter is projected to contribute a $5 billion run rate by the close of 2023.

According to Meta’s CEO, Mark Zuckerberg, the Threads innovation is anticipated to add a notable boost to the company’s growth in 2024. He outlined that if Meta successfully engages around 250 million average users by 2024 and adopts a revenue approach comparable to 50% of Twitter’s 2021 APRU ($23), the potential revenue opportunity could range between $2-3 billion for 2024.

Meta has surpassed earnings forecasts, boasting a Q2 EPS of $2.98, exceeding estimates by $0.09, and generating revenue of $32 billion, surpassing expectations by over 11% on a year-over-year basis. After experiencing declines in the previous year, Meta’s performance has skyrocketed by 130% Year-to-Date (YTD). The company displays substantial momentum, impressive gross profit and EBIT margins, and a notable count of 44 upward analyst revisions projected for the next fiscal year (FY1).

As highlighted in the presented data, Meta, alongside Amazon and Alphabet, demonstrates robust growth and profitability figures.

Meta, Amazon, and Alphabet Growth & Profitability Metrics (as of 8/22/23)

2. Amazon.com, Inc. (NASDAQ:AMZN)

Market Capitalization: $1.37 trillion

Quant Rating: Strong Buy

Quant Sector Ranking (as of 8/22/23): Ranked 3 out of 530

Quant Industry Ranking (as of 8/22/23): Ranked 1 out of 30

Boasting impressive Q2 results with an EPS of $0.65, surpassing estimates by $0.31, and revenue of $134.38 billion, exceeding expectations by nearly 11% on a year-over-year basis, Amazon has entered the Strong Buy territory after nearly three years of maintaining a Hold rating. This shift makes it an opportune moment to consider a dip-buying strategy. Amazon has made notable strides in various critical aspects, including cost reduction, enhanced customer experiences, and optimized fulfillment processes through the application of AI. Remaining a frontrunner in e-commerce, Amazon’s consistent focus on growth initiatives, such as Amazon Web Services (AWS), which heavily incorporates machine learning, has significantly bolstered its profitability. Additionally, the expansion of Amazon Prime membership has effectively attracted and retained a loyal customer base.

While, like other technology companies with a subscription model, Amazon faced certain challenges, such as declining subscriber numbers and reduced ad revenues, the company’s commitment to innovation, substantial technology investments, and integration of AI to stay competitive in a data-centric industry have positioned it as a leader. Similar to Alphabet, Amazon’s strategy revolves around widening its lead and maintaining its edge in the market. As such, both Amazon and Alphabet are noteworthy dip-buying opportunities worth considering.

3. Alphabet Inc.(NASDAQ:GOOG) and (NASDAQ:GOOGL)

Market Capitalization: $1.61T

Quant Rating: Strong Buy

Quant Sector Ranking (as of 8/22/23): 3 out of 249

Quant Industry Ranking (as of 8/22/23): 3 out of 61

Alphabet Inc., previously recognized as Google, maintains a long-standing Quant Strong Buy rating. Despite the market’s 2022 fluctuations, Alphabet’s technical expertise and strategic focus have resulted in substantial cash reserves, double that of Meta and Amazon, and a globally impressive balance sheet. With a YTD market value price-performance of +44%, Alphabet’s outlook is promising. Q2 earnings revealed an EPS of $1.44, surpassing estimates by $0.10, and revenue of $74.60B, exceeding projections by $1.85B. Though relatively expensive compared to the sector, each of my selected stocks experienced notable declines in 2022, making them relatively discounted, which appeals to investors seeking buying opportunities below their 52-week highs. Bolstered by gradually increasing quarterly price performance and bullish momentum, these top AI stocks are appealing under our quant ratings’ strong buy recommendation.

As artificial intelligence continues to reshape the tech landscape and macroeconomic challenges persist, my chosen stocks have encountered some slowdown in advertising and revenue growth. However, driven by innovative utilization of machine learning to enhance efficiency, customer base, and retention, Meta, Amazon, and Alphabet are forward-looking. Investors seeking advantageous entry points should consider these stocks during this discounted phase—a dip-buying prospect. While substantial upside potential exists, it’s crucial to acknowledge the nascent nature of the AI trend, posing inherent risks.

Risks to Tech and AI Investing

While AI is often hailed as the future’s driving force, presenting abundant growth prospects for both businesses and individuals, it’s vital to avoid concentrating too heavily in a single realm. History has shown that trends within the tech domain can escalate to the point of becoming bubbles, susceptible to bursting. The tech landscape is sensitive to various factors, such as swift price fluctuations, shifts in interest rates, competition intensity, and global geopolitical dynamics. Particularly for tech stocks that offer worldwide products and services, these intricacies come into play. The intricate nature of evolving technology, including the emergence of generative AI, can introduce potential risks encompassing cybersecurity vulnerabilities, technical complications, algorithmic manipulation, data dependence, and more. The positive aspect is that the stocks I’ve handpicked represent some of the industry’s giants, adept at withstanding headwinds and adeptly navigating their way ahead.

Conclusion

Prominent names in the tech and growth sectors, namely Meta, Amazon, and Alphabet, have experienced a remarkable resurgence since their 2022 lows, evident in their bullish momentum propelling them above their 200-day moving averages. Despite the prevailing apprehensions related to the Federal Reserve’s uncertainty, economic projections, persistent inflation, and the looming prospect of a recession, the market setbacks that led to the decline of tech stocks in the previous year have undergone a positive transformation, which can be attributed, at least in part, to the substantial potential of Artificial Intelligence.

With artificial intelligence playing a pivotal role in shaping the future, stocks with a Strong Buy rating, focused on AI and characterized by robust foundational aspects, hold the promise of sustained double-digit growth, profitability, and significant cash flow from operations over the long term. Even amid the Federal Reserve’s more stringent stance, which has impacted the earnings of many companies, my trio of stock selections have emerged as stellar performers, surpassing earnings expectations with substantial upward revisions in Fiscal Year analyst earnings over the past 90 days. These picks exhibit positive demand dynamics and steadfast fundamentals that effectively counterbalance adversities. For those seeking a comprehensive resource to make well-informed investment decisions, consider these compelling Strong Buy choices, endorsed by Seeking Alpha’s Quant Ratings and Factor Grades. Alternatively, if your interest leans toward smaller companies, our array of Top Small Caps offers various opportunities, or for a curated selection of monthly ideas sourced from the Top Quant stocks, explore the Alpha Picks option.