In a nutshell:

- All three major U.S. stock indices conclude the session with gains.

- Europe’s STOXX 600 records its most substantial monthly increase in a month.

- Global stocks rebound as a result of Beijing’s economic support measures.

- This week, a lineup of significant data is anticipated, including U.S. payrolls, PMI, GDP, and inflation figures.

On August 28, in New York, Wall Street concluded the day with gains, and U.S. Treasury yields reversed their earlier increases. This marked the initial session of a week that is anticipated to feature lower trading volume yet significant economic data, potentially influencing the Federal Reserve’s decision regarding a pause in rate hikes for September.

All three major U.S. indices progressed, although they closed below their peak levels for the session. The trading activity was relatively subdued, marking the commencement of what is often regarded as the final unofficial week of summer, a period brimming with pivotal economic indicators being closely monitored.

“I wouldn’t place my confidence in the market dynamics for this week,” remarked Chuck Carlson, who serves as the Chief Executive Officer at Horizon Investment Services located in Hammond, Indiana. “Historically, this is a week marked by minimal activity as individuals tend to remain on the sidelines. As a result, any news that surfaces tends to have an amplified impact.”

“We’re currently experiencing a period of reduced news activity until we reenter earnings season and witness more significant developments and discussions stemming from the Federal Reserve,” Carlson further elaborated.

During the central bank conference held in Jackson Hole, Wyoming, Federal Reserve Chair Jerome Powell addressed the audience on Friday. Powell acknowledged that inflation remained at elevated levels, yet he underscored the necessity for adaptable monetary policy decisions given the prevailing economic uncertainties. He emphasized the Federal Reserve’s commitment to a cautious and deliberate approach.

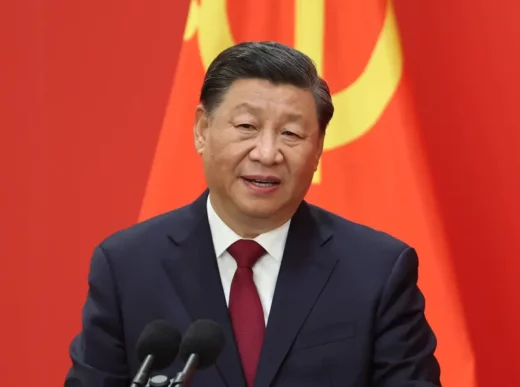

Concurrently, Beijing revealed its intention to halve the stamp duty on stock trading, an announcement that followed its recent initiative to bolster affordable housing on the previous Friday. These measures have sparked optimism that China’s economy, which has been grappling with post-COVID challenges, might shift into a higher gear from its sluggish state.

“China is facing economic challenges, and they’re not implementing the significant measures required to address them,” commented Robert Pavlik, Senior Portfolio Manager at Dakota Wealth in Fairfield, Connecticut. “Their actions seem to be incremental rather than substantial.”

“The root cause can be traced back to the impact of COVID,” Pavlik added. “The repercussions of the pandemic continue to ripple through their economy.”

As the Labor Day weekend approaches, an influx of noteworthy economic data is anticipated. This includes the August employment report, PCE inflation figures, ISM PMI, and the Commerce Department’s revised assessment of April-June GDP. These data points hold the potential to offer insights into the Federal Reserve’s upcoming policy decisions.

As of the latest update, financial markets have incorporated an 80.5% probability that the central bank will maintain interest rates during the September meeting.

The Dow Jones Industrial Average (.DJI) rose by 217.19 points, equivalent to 0.63%, reaching 34,559.98. Similarly, the S&P 500 (.SPX) recorded a gain of 27.6 points, or 0.63%, to reach 4,433.31, while the Nasdaq Composite (.IXIC) surged by 114.49 points, translating to a 0.84% increase, reaching 13,705.13.

In Europe, stocks experienced their most robust day in a month, propelled by China-related tech shares. The pan-European STOXX 600 index (.STOXX) advanced by 0.89%, and MSCI’s global stocks gauge (.MIWD00000PUS) surged by 0.83%.

Emerging market stocks displayed a 0.72% rise, and MSCI’s comprehensive Asia-Pacific shares index excluding Japan (.MIAPJ0000PUS) concluded with a 0.76% increase, while Japan’s Nikkei (.N225) surged by 1.73%.

U.S. Treasury two-year yields retreated from a nearly two-month high, as investors grappled with gauging the possibility of further rate hikes by the Federal Reserve.

Benchmark 10-year notes saw an increase of 8/32 in price, resulting in a yield of 4.2098%, compared to the previous 4.239% at the close of trading on Friday.

The 30-year bond observed an uptick of 6/32 in price, leading to a yield of 4.2831%, down from the 4.295% recorded late on Friday.

The U.S. dollar touched a nine-month peak against the Japanese yen, yet it slightly receded against a basket of global currencies after the Federal Reserve maintained the potential for additional policy tightening.

The dollar index (.DXY) experienced a decrease of 0.06%, with the euro witnessing a rise of 0.19% to reach $1.0814.

The Japanese yen weakened by 0.07% against the dollar, trading at 146.55 per dollar. Meanwhile, the British pound was seen trading at $1.26, marking a 0.18% increase for the day.

Oil prices retraced from earlier gains, driven by Beijing’s endeavors to reinvigorate its economy. However, concerns about potential tightening measures from the Federal Reserve dampened sentiment. Yet, the possibility of a tropical storm in the U.S. Gulf Coast indicated a potential supply disruption.

U.S. crude saw a 0.34% increase, settling at $80.10 per barrel, while Brent settled at $84.42, displaying a marginal 0.07% decline for the day.

Gold exhibited gains as investors continued to digest Fed Chairman Jerome Powell’s remarks from the Jackson Hole conference the previous week, while also looking forward to the forthcoming economic data.

Spot gold recorded a 0.3% increase, reaching $1,919.38 per ounce.