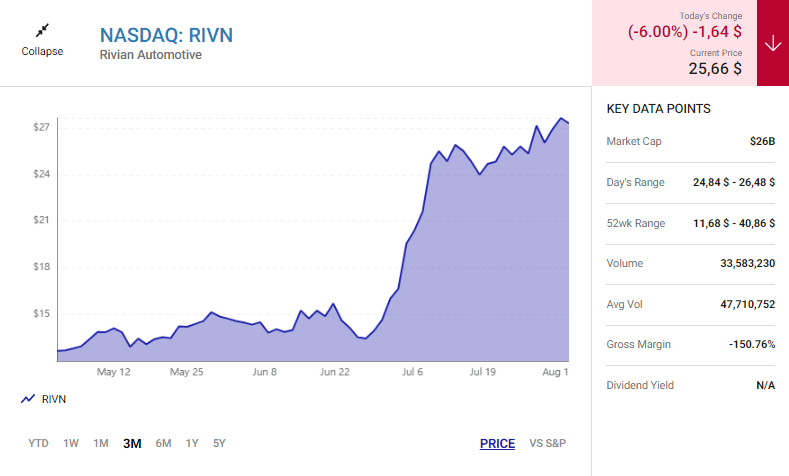

Rivian Automotive has enjoyed a remarkable surge in stock value over the past three months, more than doubling its share price. However, the recent downward trend suggests potential challenges ahead. This article examines the factors contributing to Rivian’s stock decline, particularly news from competitors, and explores the implications for the electric vehicle (EV) manufacturer.

What Prompted the Stock Decline

After initially recovering from a drop in yesterday’s trading, Rivian shares continued to head lower on Wednesday morning, experiencing a 5.3% decline. The driving force behind this downward movement appears to be news from the competition, which has raised concerns among investors.

Ford’s Impact on Rivian

Ford Motor Company, as one of Rivian’s key competitors in the electric pickup truck market with its F-150 Lightning, reported a significant 18% drop in EV sales compared to the previous year. This decline is particularly noteworthy as Ford has been striving to increase production this year. Additionally, Ford’s sales of hybrid vehicles nearly doubled those of EVs in the last month, with hybrid sales surging over 31% year over year.

The apparent decrease in demand for EVs raises questions about potential challenges ahead for Rivian. Although no demand issues were evident in Rivian’s second-quarter vehicle production and delivery report a month ago, investors are eagerly awaiting the company’s full update on August 8th for further insights.

Growing Competition Looms

Beyond Ford, Rivian faces mounting competition in the electric pickup truck market. General Motors is set to enter the scene next year with the electric version of its Silverado pickup truck. The prospect of heightened competition, coupled with Ford’s recent drop in EV sales, has investors reassessing their positions and taking some profits after Rivian’s impressive stock surge.

Looking Ahead

The upcoming Rivian quarterly update is poised to be a critical catalyst for the company’s stock trajectory. Investors will closely analyze the report for any signs of demand shifts and market response. Additionally, they will monitor how Rivian addresses the growing competition in the EV space, particularly as Ford ramps up production with triple the capacity.

Conclusion

While Rivian’s stock experienced a remarkable ascent over the past three months, recent developments have prompted caution among investors. News of Ford’s decline in EV sales and the anticipation of increased competition have led to a temporary setback in Rivian’s stock performance. As the company prepares to release its quarterly update, market watchers are eager to gain further insights into Rivian’s growth trajectory and how it plans to navigate the evolving landscape of the electric pickup truck market.