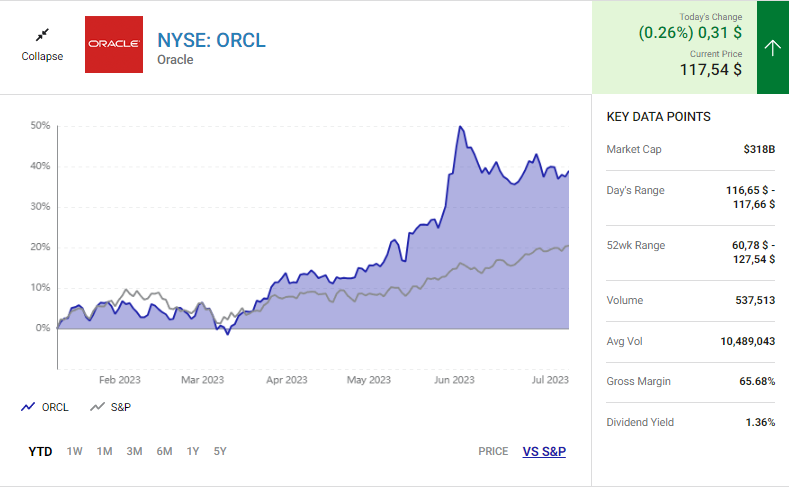

The AI mania of 2023 has given database software veteran Oracle a significant boost in its stock price, bringing it on par with sector rival Microsoft. However, a deeper analysis reveals doubts about Oracle’s true standing in the AI landscape. In this article, we will explore why Oracle’s AI stock may not be as promising as perceived, comparing it to Microsoft’s approach and market position. From partnership choices to open-source database competition, Oracle faces challenges that could impact its future growth and make it less appealing compared to other AI investments.

Oracle’s AI Partnerships

Unlike Microsoft, which has made notable strides in the AI realm by partnering with OpenAI, Oracle’s AI initiatives seem less ambitious. While Microsoft has an exclusive computing partnership with OpenAI and a $10 billion investment in the company, Oracle’s choice of a smaller generative AI specialist named Cohere falls short. Cohere may have a strong pedigree of AI researchers and visionaries, but it lags behind OpenAI’s significant head start. The absence of Oracle’s founder and chairman, Larry Ellison, from the list of backers further raises questions about the company’s AI commitment.

Missed Opportunities with Google

In an ideal scenario, Oracle could have strengthened its AI ambitions by collaborating with Google parent Alphabet, an AI veteran. However, past legal disputes between Oracle and Google over Java programming concepts have likely hindered any meaningful partnership. The lack of a strong ally like Alphabet in the AI field leaves Oracle with lower-grade AI ambitions, which should be reflected in its stock valuation.

AI Not the Only Concern

Beyond the AI landscape, Oracle faces fierce competition from open-source database alternatives like MongoDB, PostgreSQL, and ElasticSearch. Despite acquiring MySQL, a significant open-source database, Oracle’s management hasn’t fully embraced the open-source philosophy, allowing hungry upstarts to erode its market share. This competition has hindered Oracle’s growth, while Microsoft continues to show consistent business expansion.

Conclusion

While Oracle’s AI stock has benefited from the market hype, a more comprehensive analysis reveals concerns about its competitive standing and strategic choices. In contrast to Microsoft’s exclusive and successful partnership with OpenAI, Oracle’s collaboration with Cohere falls short. Furthermore, Oracle’s struggles with open-source database competition have added to its challenges. As investors seek promising AI opportunities, other options in the market may offer more attractive prospects than Oracle’s stock. In conclusion, Oracle’s AI stock demands a risk-based discount and may not be the optimal choice for investors seeking strong AI investments in the current market landscape.