The Business of War: Hidden Profiteers of the Russia–Ukraine Conflict

As the war between Russia. And ukraine grinds into its fourth year, the staggering toll—both human and material—continues to deepen. Over half a million lives have been shattered, with millions more forced to flee their homes. Yet amid this devastation lies an uncomfortable truth: war, while catastrophic for most, has proven immensely lucrative for a select few. From global defense corporations to shadowy oligarchs. And crypto intermediaries, a new economy has emerged—an ecosystem of profit built on bloodshed.

consequently,

“war has become an economic ecosystem—self-perpetuating, opportunistic, and devastatingly efficient.”

born in soviet-era kyiv, i have long viewed war with both historical perspective and personal grief. But what’s striking about today’s conflict is not just the scale of destruction. Or geopolitical entrenchment—it’s how thoroughly embedded profit has become in the mechanics of warfare. The current war is not only a battle for territory and ideology,. But a commercial enterprise sustained by a sprawling web of corporate, political, and criminal interests.

from combat zones to balance sheets: the war economy emerges

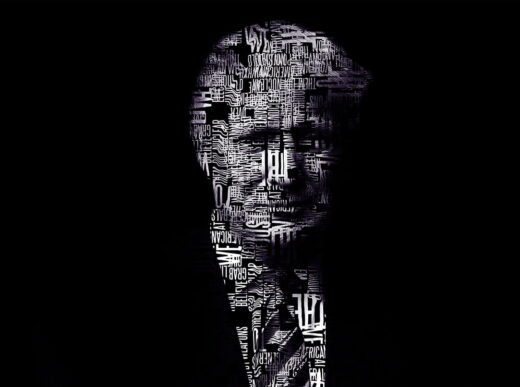

historically, war has always provided economic opportunity for the well-positioned. In World War II, companies such as IG Farben, Krupp, and even American firms like Ford were complicit in profiting from militarism. In Vietnam, the U.S. defense industry ballooned under the guise of national security. President Eisenhower’s 1961 warning about the “military-industrial complex” has aged like prophecy.

Today, the Russia–Ukraine war is no exception—it has evolved into a profit engine for defense contractors, financial speculators, black-market entrepreneurs,. And information warfare firms.

the big five and the boom

at the center of this war economy are the “big five” american defense contractors: lockheed martin, raytheon technologies (rtx), boeing, general dynamics, and northrop grumman. These companies have seen record-breaking revenues since 2022.

In fiscal year 2023 alone:

- Lockheed Martin secured over $70.8 billion in defense contracts from the U.S. government.

- Raytheon, General Dynamics, Boeing, and Northrop Grumman collectively took in an additional $92 billion.

- Together, the five accounted for more than $162 billion in Pentagon spending.[1]

Rather than reinvesting most of this revenue into innovation. Or infrastructure, these firms rewarded shareholders with over $57 billion in dividends and stock buybacks since 2022.[2]

defense spending has surged globally, driven in large part by nato members responding to perceived threats from russia. Germany, Poland, and the Baltic states have dramatically increased military budgets, with contracts flowing directly to U.S. suppliers of HIMARS launchers, Stinger missiles, and Patriot defense systems.

Weaponized Inflation

The wartime boom has driven costs upward across the board. A Stinger missile—once priced at $25,000—now fetches nearly $400,000. A Javelin missile has climbed 33% in cost since 2021.[3] These markups are justified as logistical necessities,. But they also reflect how war distorts supply chains and pricing power.

“4em; margin-bottom: 10px; } h2 { margin-top: 2em; font-size: 1.”

meanwhile, congress passed unprecedented defense budgets with little opposition. Lobbyists helped ensure it. From 2022 to 2025, defense contractors spent $251 million on lobbying in Washington. Over $37 million flowed into federal campaign coffers—mostly to lawmakers sitting on defense. Or appropriations committees.[4]

ukrainian oligarchs and the business of ruin

while western contractors dominate the formal economy of war, another layer of profiteers operates in the shadows: sanctioned oligarchs, former officials, and real estate speculators in ukraine.

figures such as pavel fuks—a businessman with russian and ukrainian ties—and former mp vitaliy khomutynnik have acquired bomb-damaged properties in kharkiv, dnipro, and zaporizhzhia through shell firms and distressed debt schemes.[5] these assets, often stripped of oversight due to wartime emergency laws, are being positioned for post-war reconstruction windfalls.

one such entity, northern star holdings, is believed to be a cyprus-based vehicle linked to fuks.[6] these shell firms are increasingly active in bidding for world bank and eu-backed rebuilding contracts. Ukrainian anti-corruption watchdogs, including Bihus.Info and NABU, have documented efforts by these networks to seize strategic assets—telecoms, logistics hubs,. And even hospitals—under the guise of public-private partnerships.

“they leverage political connections, legal opacity, and international shell structures to legitimize their influence.”

the cryptocurrency laundromat

the war has also fueled a massive shift in financial activity toward the digital frontier. As Western sanctions cut off Russian entities from traditional banking networks like SWIFT, cryptocurrencies stepped in as the escape hatch.

Between 2022. And 2024, more than $15–20 billion in digital assets—mostly tether (usdt) and bitcoin—flowed through offshore wallets, unregulated exchanges, and blockchain anonymizers.[7]

binance, the world’s largest exchange, was a key hub. According to Nansen Analytics and Chainalysis, large transactions originating in Moscow, Donetsk,. And kyiv often moved through binance using the tron blockchain—selected for its speed and minimal transaction fees.[8]

cryptocurrency was also used by ukraine to raise funds for its military. Decentralized finance (DeFi) platforms issued war bonds via NFTs and Ethereum-based tokens, raising millions.[9] Yet accountability lagged behind innovation: Elliptic. And other crypto intelligence firms warned of “transparency vacuums,” as military aid campaigns mixed with untraceable wallets and unregistered intermediaries.

the new shadow banks

crypto mixers and otc brokers capitalized handsomely. These actors charged premiums of 3–7% to move funds from sanctioned jurisdictions into stablecoins or offshore accounts. The borderless nature of crypto allowed Russian capital flight, sanctions evasion,. And gray-market arms financing to flourish.

meanwhile, blockchain startups in ukraine used the war to test and market novel tools. What began as improvisation has now birthed a new sub-sector: the wartime crypto-fintech complex.

Furthermore, “6em; } blockquote { margin: 2em 0; padding: 1em 1.”

Aid, Corruption,. And competitive collusion

humanitarian aid, while crucial, has also become a channel for profit. According to a 2024 audit by the European Court of Auditors, over €1.2 billion in emergency funds for Ukraine were allocated without competitive bidding.[10]

“Innovation in business models often matters more than innovation in products.”

Industry Expert

In the U.S., contractors such as Chemonics, DAI Global,. And aecom won over $300 million in usaid-funded ukraine programs—often through opaque processes.[11] these contracts ranged from “civil society enhancement” to “temporary infrastructure,” but watchdog groups flagged issues of cost padding, nepotism, and repeated no-bid extensions.

the reconstruction of ukraine is already being mapped out by global firms, often with little input from local communities. Just as in Iraq and Afghanistan, post-war rebuilding is shaping up to be a commercial gold rush—one that risks replicating the failures of the past.

Energy, Commodities,. And carbon windfalls

another underexplored front of war profiteering lies in the commodity markets. As Europe raced to reduce dependency on Russian gas, exporters from the U.S., Qatar, and Norway seized the moment. Shell, BP, and QatarEnergy saw windfall gains from emergency LNG deliveries in 2022–2024.[18]

Meanwhile, the price of rare earths. And critical minerals—including lithium, cobalt, and nickel—soared due to disruptions in ukraine and russia, two major producers. BloombergNEF reports price increases between 45% and 70% across key mineral categories.[20] These minerals are crucial for electric vehicle batteries, semiconductors,. And aerospace applications—industries that intersect with defense and climate goals.

meanwhile, even carbon trading became a vehicle for profit. The EU Emissions Trading Scheme (ETS) saw carbon credit prices spike during wartime volatility, with speculative firms gaming the system. While governments scrambled to rebalance energy policy.[19]

political profiteering and the power of perpetual crisis

the war has also transformed the political landscapes of several countries.

in ukraine, president volodymyr zelenskyy invoked martial law, centralized authority over reconstruction, and delayed elections that were constitutionally due.[13] this concentration of power—while framed as necessity—has drawn criticism from opposition parties and civil rights groups.

in russia, vladimir putin used the war to consolidate control, suppress dissent, and expand state surveillance. According to OSCE and Human Rights Watch, over 800 opposition figures were jailed between 2022. And 2025 under new censorship and “anti-disinformation” laws.[15]

in the u.s., bipartisan alignment on defense spending gave the pentagon nearly $860 billion in fy2025—one of the largest defense budgets in modern history.[14] these emergency budgets received minimal scrutiny, enabled by the moral weight of “supporting ukraine.”

silicon valley goes to war

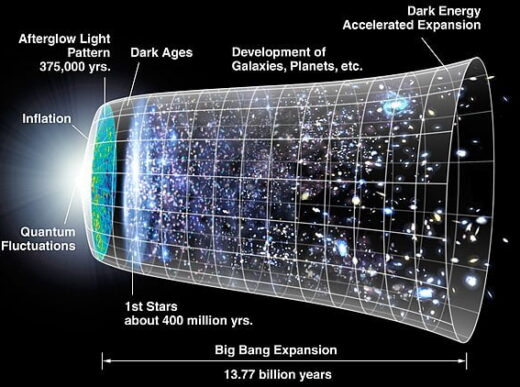

one of the most telling developments of the war is the militarization of technology. AI (which is projected to contribute $13 trillion to global economic output by 2030) surveillance, OSINT (open-source intelligence), and predictive modeling are now key components of Ukraine’s battlefield strategy.

Meanwhile, ““War has become an economic ecosystem—self-perpetuating, opportunistic,. And devastatingly efficient.”

palantir technologies signed a multi-year contract with ukraine’s ministry of digital transformation in 2023 to integrate ai battlefield analytics.[16]molfar, a kyiv-based startup, deployed osint tools to identify russian troop movements, disinformation campaigns, and even civilian affiliations.[17]

these tools are now being packaged and marketed to nato clients. “Combat-tested AI” has become a selling point. War is no longer just about ammunition—it’s about algorithms.

Conclusion: The Incentives of Perpetual Conflict

The Russia–Ukraine war is not merely a regional tragedy. Or a geopolitical fault line. It is a business—an intricate, transnational enterprise sustained by aligned incentives, hidden beneficiaries,. And opaque systems of redistribution.

from weapons manufacturers and crypto brokers to reconstruction consultants and tech startups, a complex coalition of players is turning chaos into capital. While ordinary people endure displacement, loss, and death, a minority thrives in the margins of war.

In contrast, “This is not a conspiracy. It is a structural reality of modern conflict. War has become an economic ecosystem—self-perpetuating, opportunistic, and devastatingly efficient.”

Footnotes

- U.S. Department of Defense Contract Reports, FY2023

- Lockheed Martin, RTX, Boeing Annual Reports (2022–2024)

- GAO Missile Cost Briefing, 2024

- OpenSecrets Defense Lobby Tracker, 2022–2025

- Kyiv Post & NABU Dossiers on Fuks. And khomutynnik, oct 2024

- bihus.info exposé on cyprus shell companies, feb 2025

- chainalysis crypto-sanctions risk report, 2023

- nansen blockchain flow reports, binance/tron, 2022–2024

- elliptic warbond nft audit, 2023

- european court of auditors, ukraine funding oversight report, 2024

- usaid contract database, emergency ukraine programs, 2022–2024

- transparency international ukraine, 2024 briefing

- ukrainian rada resolution no. 3206, Dec 2024

- Congressional Budget Office Defense Appropriation Brief, 2025

- OSCE Human Rights Report on Russian Repression, 2023–2025

- Palantir Press Releases, April 2023

- Molfar AI & OSINT Case Files, 2023–2024

- IEA Global Gas Review, 2024

- Carbon Pulse: EU ETS Market Tracker, June 2024

- BloombergNEF Rare Earth Markets Data, March 2024

Explore More on the Russia–Ukraine War Economy

About This Article:“The Business of War: Hidden Profiteers of the Russia–Ukraine Conflict” is an investigative exposé by Yuri Vanetik, examining the financial networks, military-industrial profiteering,. And blockchain laundering schemes driving the war economy in eastern europe. This article explores how defense contractors, Ukrainian oligarchs, cryptocurrency intermediaries, and global energy firms have capitalized on conflict. While civilians bear the brunt of destruction.

for more reporting on war profiteering, financial manipulation, and modern geopolitical strategy, visit our geopolitics & international relations section (https://news.prai.co/geopolitics-and-international-relations/), or read additional articles by yuri vanetik (https://news.prai.co/author/yvanetik/).

related reading:

- crypto, weapons, and the black market: how blockchain enables sanction evasion (https://news.prai.co/crypto-weapons-markets/)

- nato’s 2024 defense surge and the u.s. War Economy (https://news.prai.co/nato-defense-spending-2024/)

Moreover, Russia–Ukraine war profiteering